Form 05-163 For 2024. The faqs include information clarifying that: See the tx comptroller's website for details.

Refer to this article for more information. Greater than $2,470,000 but less than $20 million:

1) The Franchise Tax Is A Privilege Tax Imposed On Each Taxable Entity Formed Or Organized In The State Or Doing Business In The State;

Beginning in 2024, each of these entities.

Refer To This Article For More Information.

For tax year 2023 and prior:

The Faqs Include Information Clarifying That:

Images References :

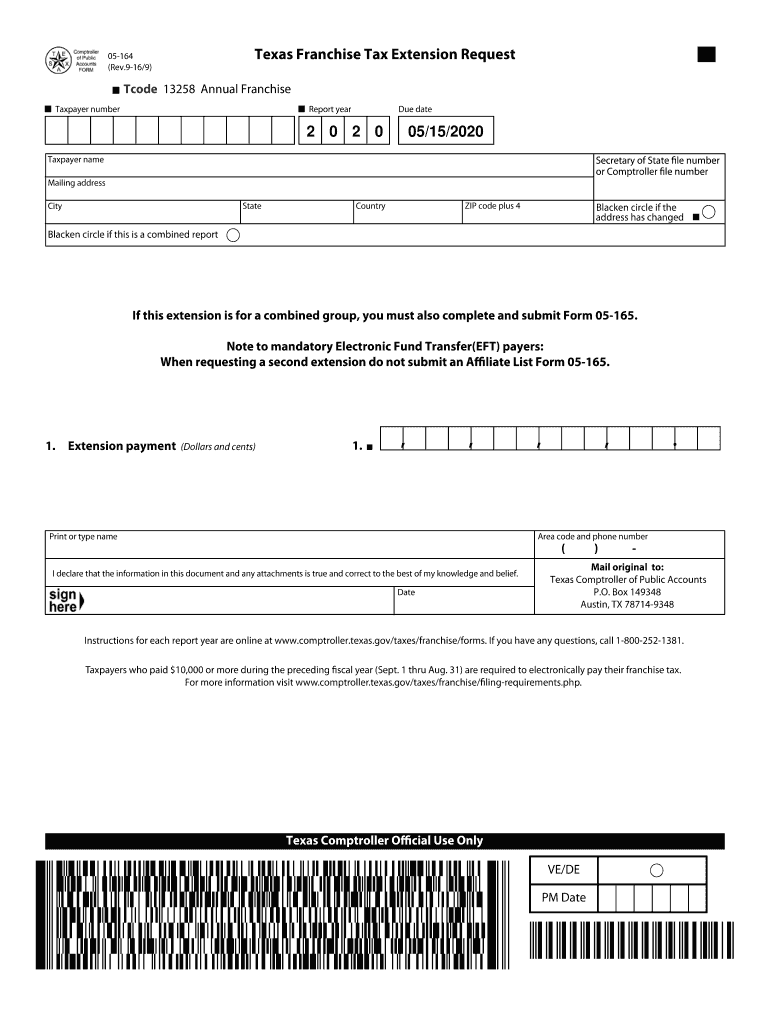

Source: www.uslegalforms.com

Source: www.uslegalforms.com

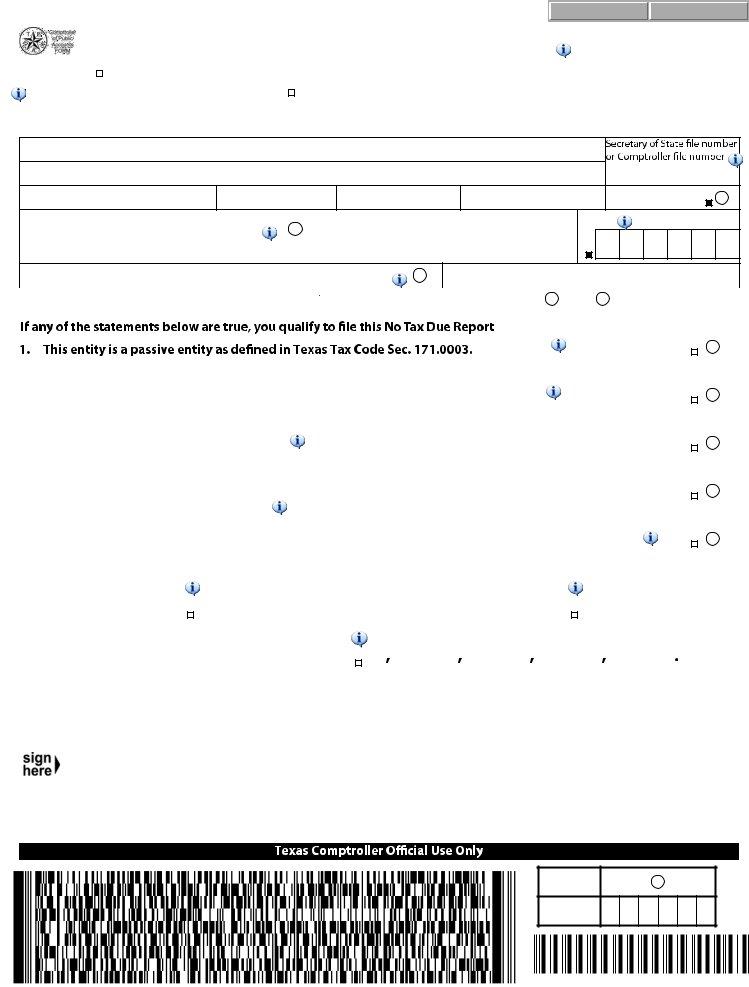

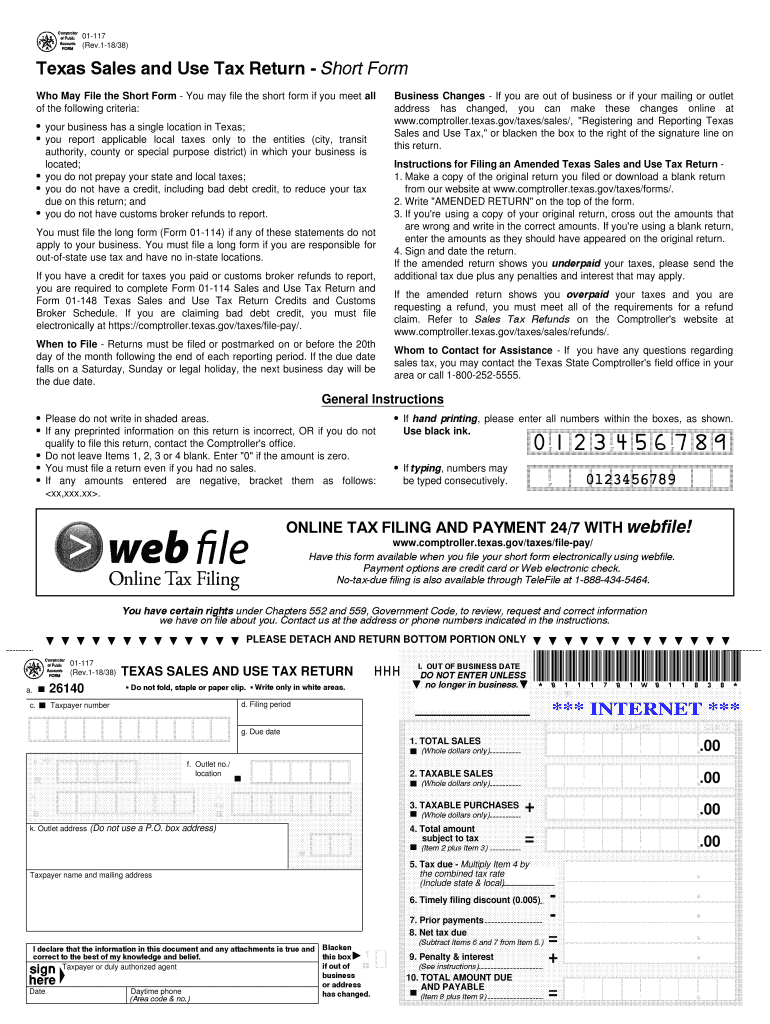

TX Comptroller 05163 2022 Fill and Sign Printable Template Online, The faqs include information clarifying that: This official video from the texas comptroller of public accounts shows you how to file a no tax due information report.visit the texas comptroller's webfile.

Source: www.signnow.com

Source: www.signnow.com

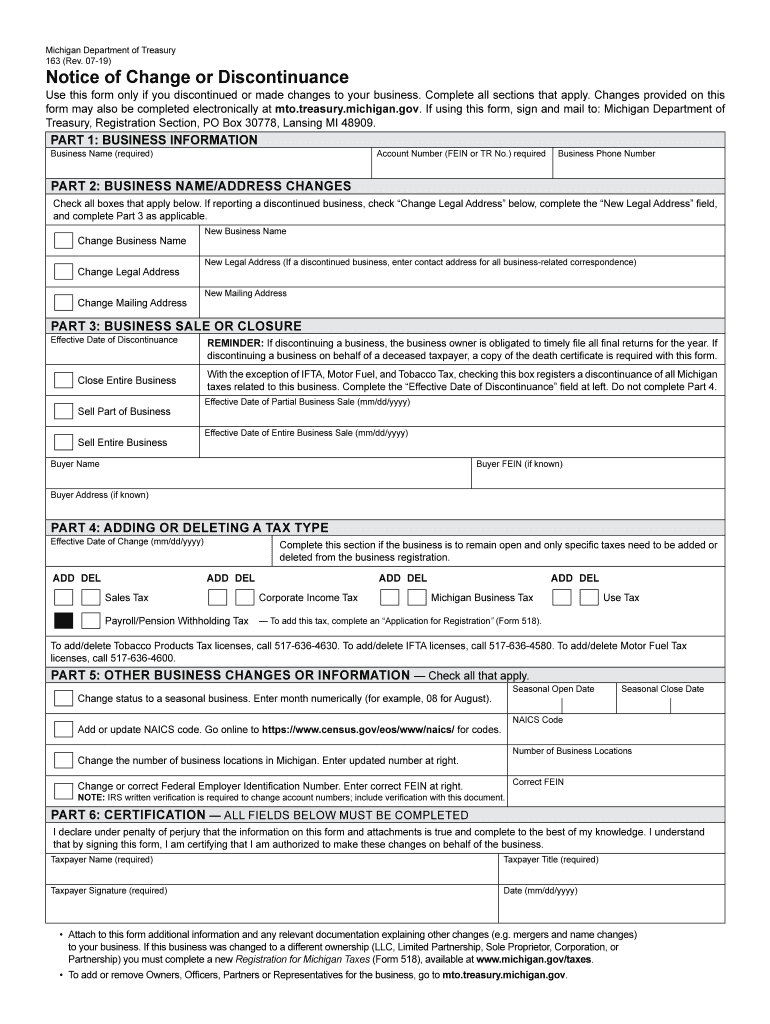

Comptroller Texas Gov Taxes Franchise Forms Fill Out and Sign, The faqs include information clarifying that: There were five types of entities eligible to file a no tax due report.

Source: kinomax.ru

Source: kinomax.ru

Киномакс МУЛЬТ в кино. Выпуск №163, If an input for a checkbox is not located on this screen then it will be located on the texas franchise tax. Beginning in 2024, each of these entities.

Source: www.roadtax2290.com

Source: www.roadtax2290.com

Prepare and File form 2290, EFile Tax 2290., There were five types of entities eligible to file a no tax due report. For reports originally due on or after jan.

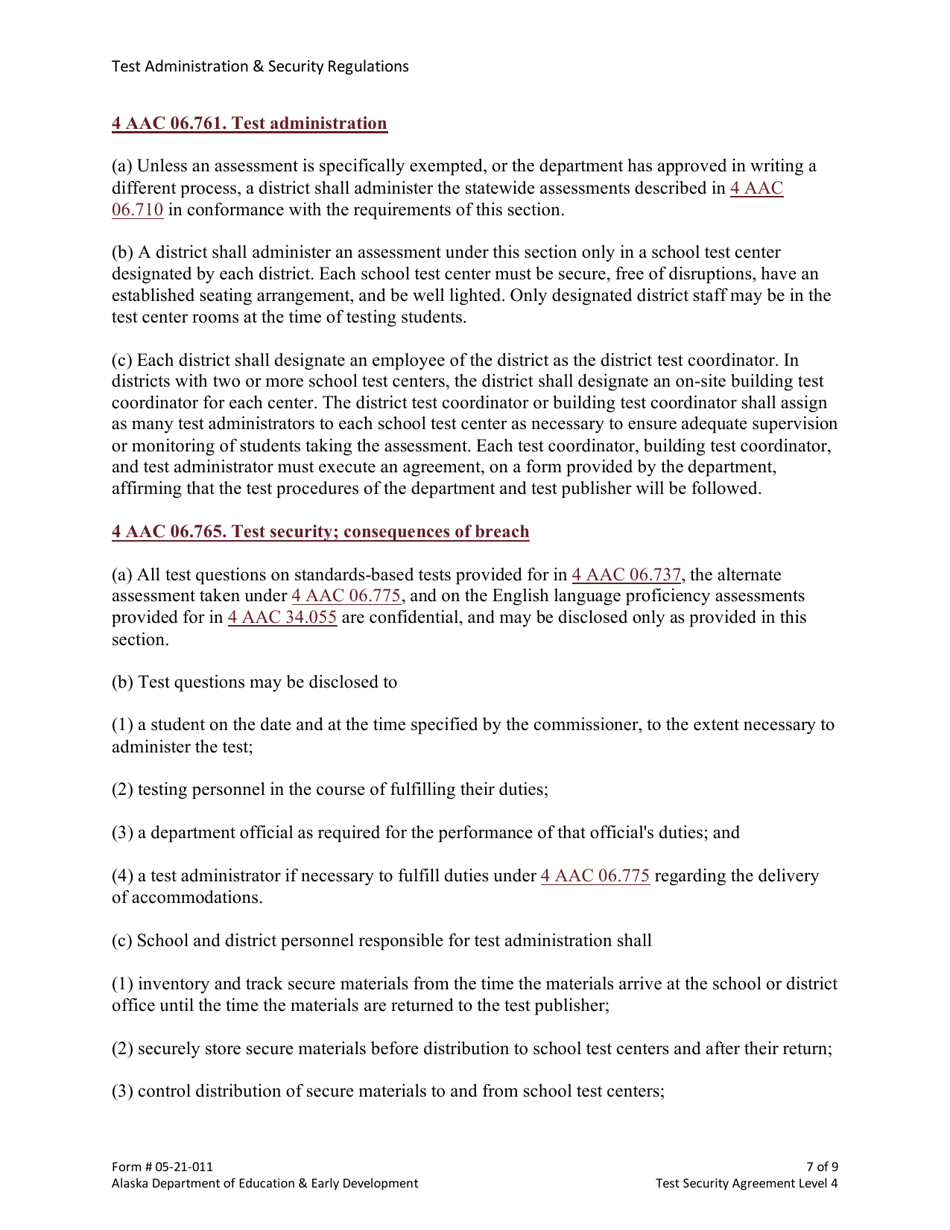

Source: www.templateroller.com

Source: www.templateroller.com

Form 0521011 Download Fillable PDF or Fill Online Test Security, For tax year 2023 and prior: Refer to this article for more information.

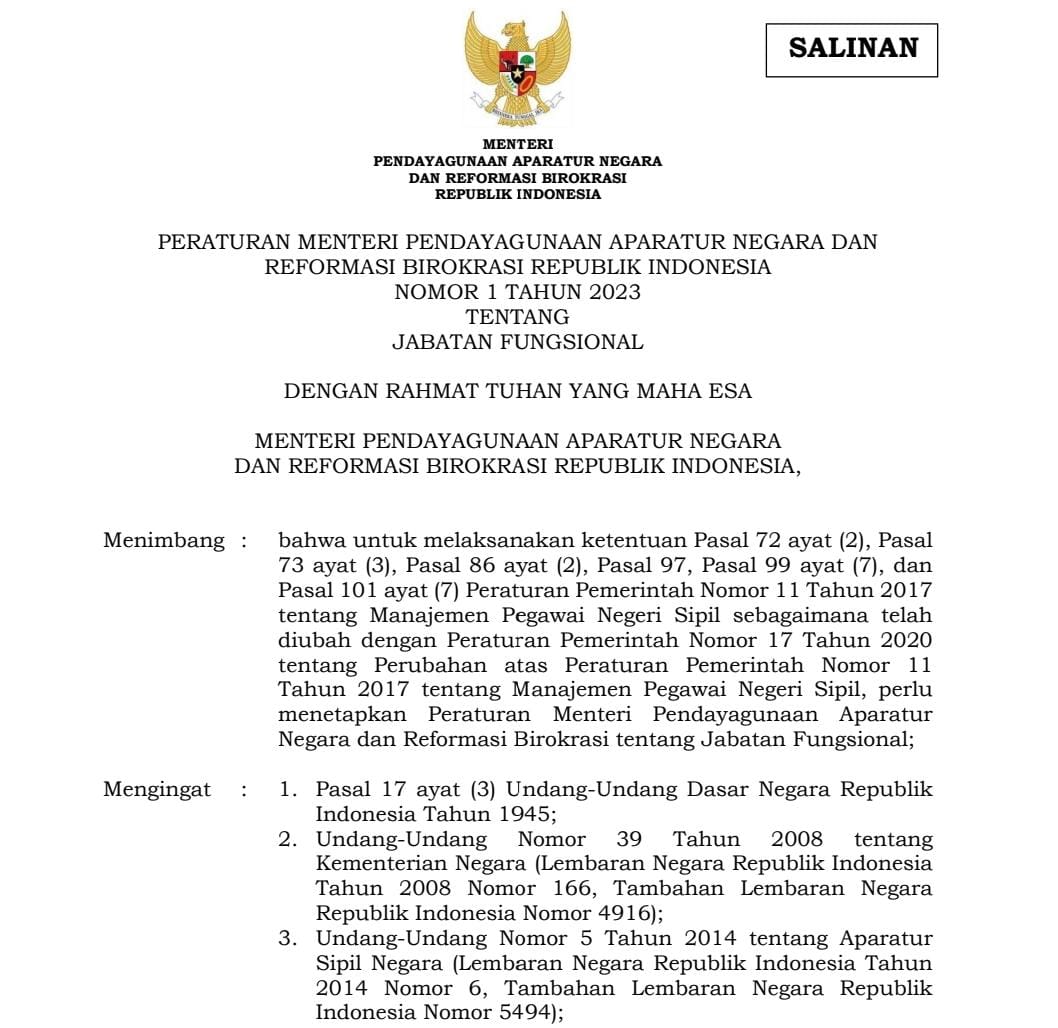

Source: smartid.co.id

Source: smartid.co.id

Peraturan Menteri Pendayagunaan Aparatur Negara dan Reformasi Birokrasi, For reports originally due on or after jan. The texas comptroller of public accounts march 28 issued answers to frequently asked questions for franchise taxpayers on passive entities, for corporate.

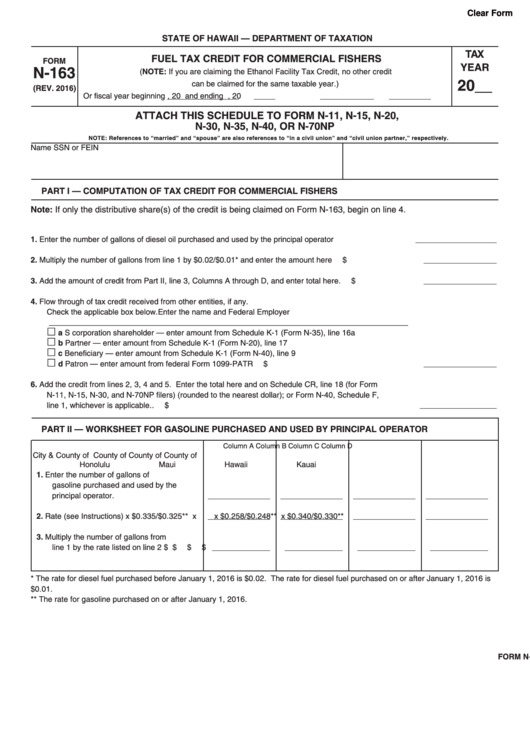

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form N163 Fuel Tax Credit printable pdf download, There is no minimum tax requirement under the franchise tax. See the tx comptroller's website for details.

Source: formspal.com

Source: formspal.com

Form 05 163 ≡ Fill Out Printable PDF Forms Online, See the tx comptroller's website for details. The faqs include information clarifying that:

Source: www.dochub.com

Source: www.dochub.com

Form 01 117 Fill out & sign online DocHub, For reports originally due on or after jan. If an input for a checkbox is not located on this screen then it will be located on the texas franchise tax.

Source: www.dochub.com

Source: www.dochub.com

Michigan form 163 Fill out & sign online DocHub, The faqs include information clarifying that: There were five types of entities eligible to file a no tax due report.

There Were Five Types Of Entities Eligible To File A No Tax Due Report.

The faqs include information clarifying that:

Beginning In 2024, Each Of These Entities.

The texas comptroller of public accounts march 28 issued answers to frequently asked questions for franchise taxpayers on passive entities, for corporate.