Tax Free Threshold 2024 For Seniors. Older adults have special tax situations and benefits. Individuals who are age 55 or older by the end of the tax year are eligible to contribute up to $5,150 to a health savings account in 2024.

From 1 july 2024, the proposed tax cuts will: Use these tax rates if you were both:

How To Determine Your Eligibility For The Seniors And Pensioners Tax Offset When You Lodge Your Return Using Mytax.

Reduce the 32.5 per cent tax rate to 30.

The 32.5% Marginal Tax Rate Will Be Lowered To 30% For A Substantial Bracket Spanning From.

These changes are now law.

Tax Free Threshold 2024 For Seniors Images References :

Source: dynaqfrancoise.pages.dev

Source: dynaqfrancoise.pages.dev

New Tax Brackets 2024 Calculator Viki Almeria, From 1 july 2024, the proposed tax cuts will: Use these tax rates if you were both:

Source: imagetou.com

Source: imagetou.com

Tax Thresholds Uk 2024 Image to u, The seniors and age pension tax offset (sapto) provides valuable financial assistance to eligible australian seniors and pensioners. Because qcds can start at age 70½ — before retirees must take rmds — doing them earlier can move money from an.

Source: legalkitz.com.au

Source: legalkitz.com.au

Understanding TaxFree Threshold Meaning What You Need to Know to Keep, This is known as the shade out threshold. From 1 july 2024, the proposed tax cuts will:

Source: printableformsfree.com

Source: printableformsfree.com

Tax Rates 2023 Vs 2024 Printable Forms Free Online, These updates to the tax code will go into effect for 2024 tax returns, meaning. In most cases, you must pay estimated tax for 2024 if both of the following apply.

Source: tupuy.com

Source: tupuy.com

Ato 2024 25 Tax Rates Printable Online, These changes are now law. The seniors and age pension tax offset (sapto) provides valuable financial assistance to eligible australian seniors and pensioners.

Source: thomasinawcarena.pages.dev

Source: thomasinawcarena.pages.dev

New Irs Tax Tables For 2024 Rahel Carmelle, Get general information about how to file and pay taxes,. Come 1 july 2024, the stage 3 tax cuts will bring significant changes to tax brackets.

Source: rodgers-associates.com

Source: rodgers-associates.com

Simplifying Taxes IRS Form 1040SR Rodgers & Associates, If you had a tax liability for 2023, you may have to pay estimated tax for 2024. Reduce the 19 per cent tax rate to 16 per cent.

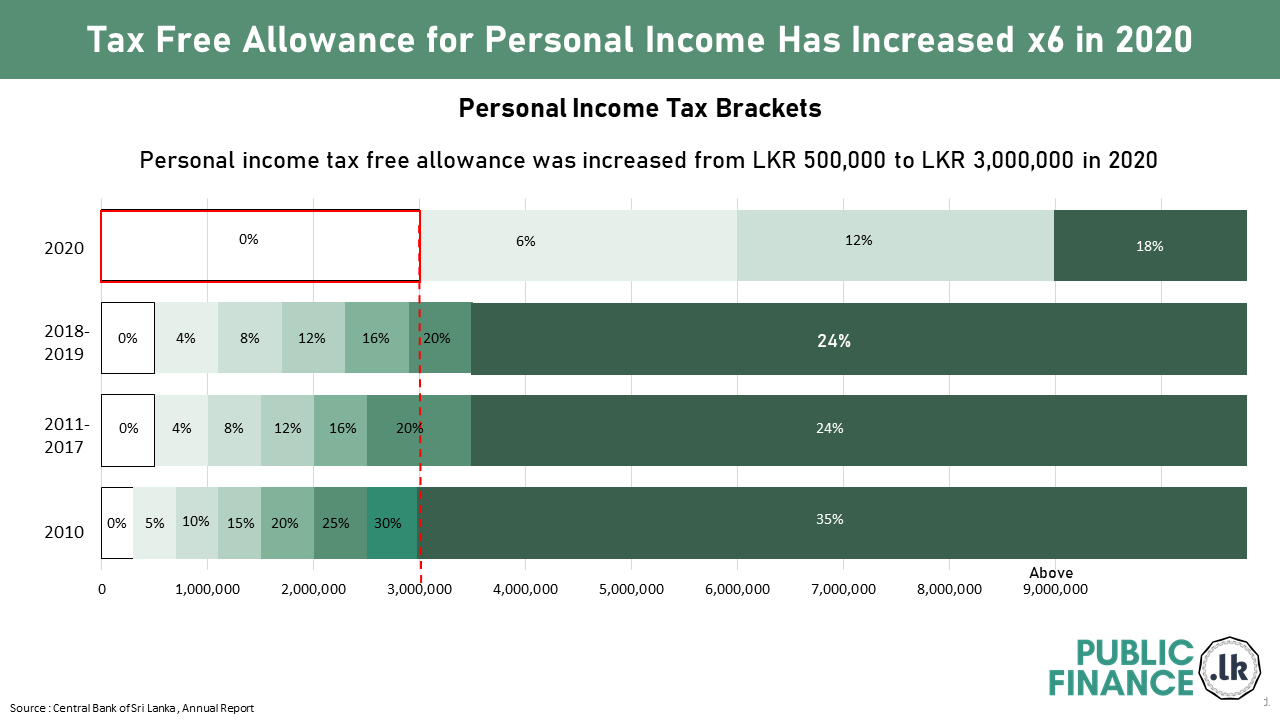

Source: publicfinance.lk

Source: publicfinance.lk

Tax Threshold Changes, If you are entitled to the seniors and pensioners tax offset (sapto) you do not have to pay the medicare levy if your taxable income is less than $41,089, and the amount of medicare levy you pay will be reduced if. Reduce the 32.5 per cent tax rate to 30.

Source: itp.com.au

Source: itp.com.au

HECS / HELP Debt. What The Heck? ITP Accounting Professionals, You receive the maximum offset if your rebate income is less than the shading. An australian resident for tax purposes for the full year.

Source: seniorsleague.org

Source: seniorsleague.org

56 of Social Security Households Pay Tax on Their Benefits — Will You, Understand how that affects you and your taxes. Rates and thresholds for seniors and pensioners tax offset.

How To Determine Your Eligibility For The Seniors And Pensioners Tax Offset When You Lodge Your Return Using Mytax.

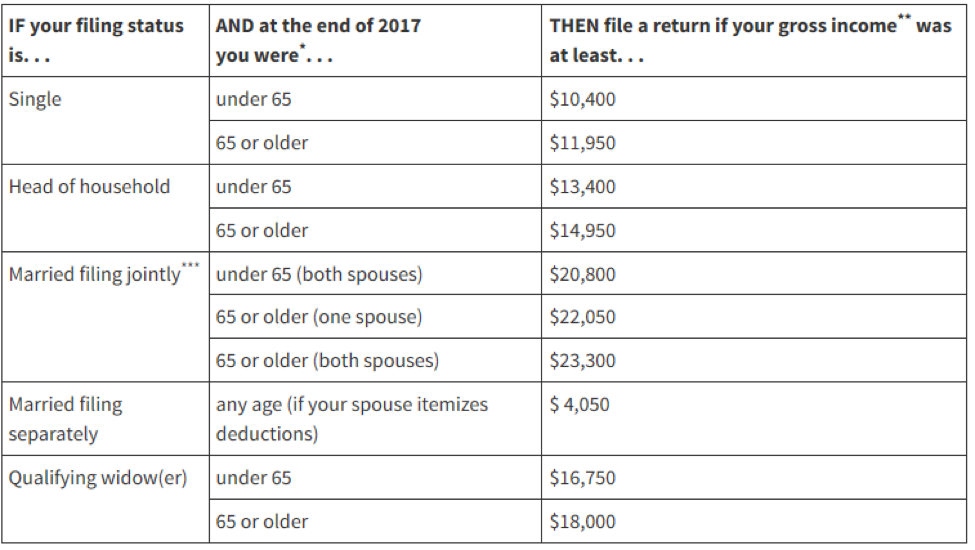

The threshold for seniors aged 65 or older stands at $14,700 for single filers and $28,700 for joint filers (who are both age 65 or older) in 2023.

The Seniors And Age Pension Tax Offset (Sapto) Provides Valuable Financial Assistance To Eligible Australian Seniors And Pensioners.

The 32.5% marginal tax rate will be lowered to 30% for a substantial bracket spanning from.

Posted in 2024